How to File an Alaska Biennial Report

Instead of an Annual Report, Alaska requires reports be filed Biennially. You can file it yourself. We’ll show you how.

Alaska Biennial Report Overview

Annual reports are essential for maintaining the good standing of your business with the state of Alaska. They provide updates on your company’s current information, ensuring compliance with state regulations, and helping the state track business activities.

Initial Report- The first version of your Biennial Report is called the Initial Report and must be filed within 6 months of forming or registering your Alaska business. The Initial Report is filed the same way the Biennial Report is. There is no fee for the Initial Report.

File Your Alaska Biennial Report Online

The best and easiest way to file your Biennial Report is online. Here’s how.

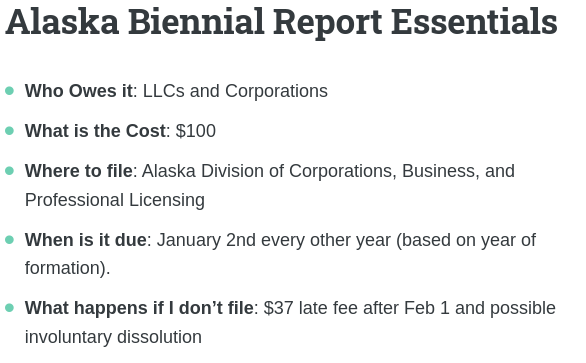

Step 1. Determine the Cost and due date

Biennial Reports are due:

- February 2nd, every other year, for all for profit entities

- August 2nd for non-profits and cooperatives

The Biennial Report fee differs based on the type of entity you run:

- $100 – For all domestic corporations, LLCs, Professional corporations, and LLPs

- $200 – For all foreign corporations, LLCs, Professional corporations, and LLPs

- $25 – For all non profit/religious organizations

- $100 – Cooperatives

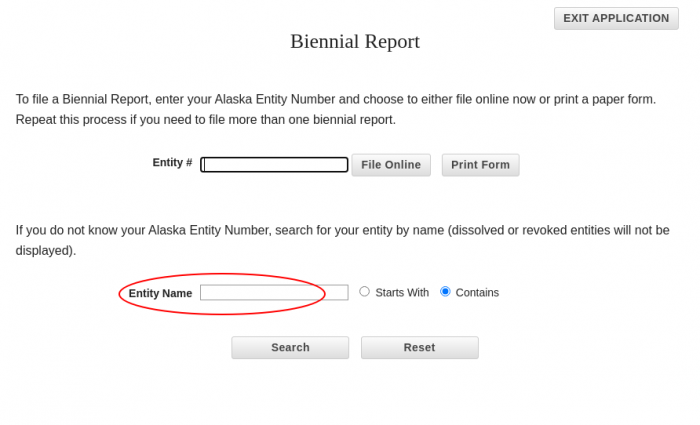

Step 2. Visit the Alaska State Biennial Report Page

Visit the Biennial Report page at the Alaska State Corporations, Business, and Professional Licensing site. Click, “Proceed to online filing”.

Step 3. Gather the Necessary Data

It’s recommended to have all required information at hand before you can begin, because if you time out, you’ll have to start over. You’ll need:

- Company name and address

- Registered Agent name and address (this can only be changed using a separate form).

- Member/Manager or Director/Officers names and addresses

Step 4. Find Your Business Entity Number

Search for your business entity using the Alaska State Business Search Bar, entering your company’s name or Entity ID number.

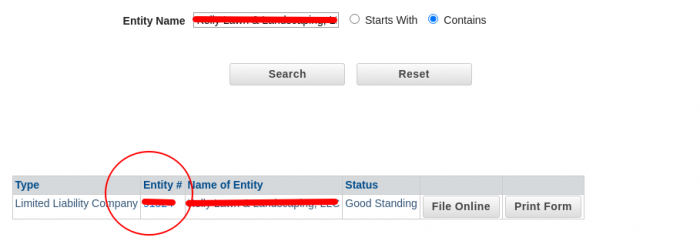

Step 3. Obtain Your Entity Number from the List

Once you’ve identified your business from the list provided, you’ll be able to view your entity number. Click on the button that says, File Online.

Step 4. Verify Existing Information

You’ll need to verify the information listed above.

Step 5. Pay the Amount Owed

You can pay securely with all major credit cards.

Deadlines and Filing Fees

The deadline for filing your annual report in Alaska is January 2nd every other year. It’s based on the year your company was formed. You’ll file on even years if you formed in an even year and odd years if formed in an odd year. The cost of filing the report is a flat fee of $100 for both domestic LLCs and corporations. It’s a $200 for for all foreign LLCs and corporations. You’ll file an initial report in the year you form, but there is no cost for filing the initial report for domestic companies.

Consequences of Late Filing

If you fail to file your annual report on time, you may be subject to a $37 late fee after February 1. Late filing may also put your business at risk of involuntary dissolution, which means the state could dissolve your company.

Alaska Biennial Report Frequently Asked Questions

Alaska biennial reports serve as a means of documenting and evaluating the financial condition and performance of state agencies and departments within a two-year period.

The Alaska Division of Legislative Finance is responsible for overseeing the preparation and submission of biennial reports, ensuring accuracy and compliance with reporting requirements.

Alaska biennial reports play a crucial role in informing budgetary decisions and policy-making processes. They provide legislators and policymakers with a comprehensive understanding of agency expenditures, revenue sources, program outcomes, and potential areas for improvement.