How to File the California Statement of Information

California does not require an annual report. Instead, they require a “Statement of Information” to be filed initially upon formation or registration and then again every two years. You can do it yourself. We’ll show you how.

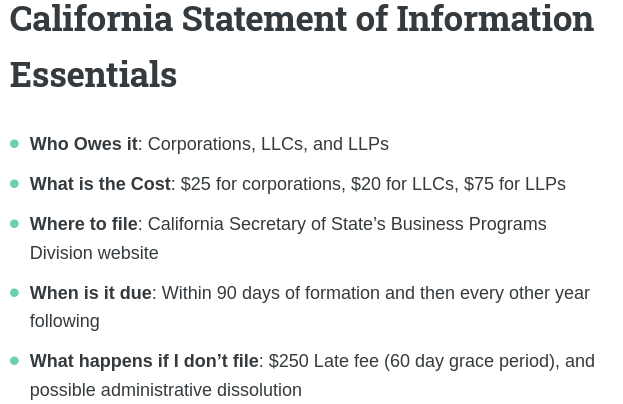

CA Statement of Information Overview

Annual reports, known as Statements of Information in California, provide the state with updates on your company’s current information, ensuring compliance with state regulations, and help the state track business activities. We’ll walk you through step-by-step instructions on how to file it so you can maintain your good standing with the state.

Step-by-Step Guide to Filing Your Annual Report Online

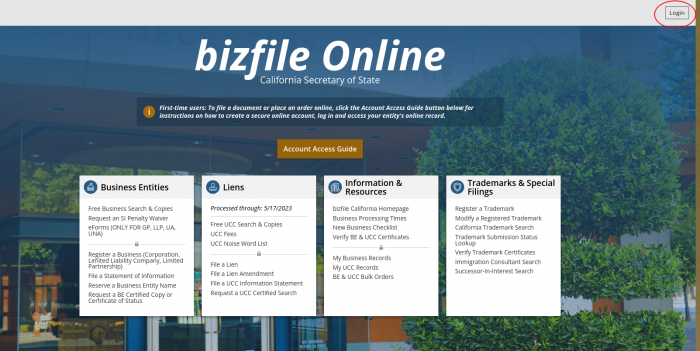

Step 1: Create Your Secure Account

Create an account on the California Secretary of State’s BizFile. To do so, click “Login” in the top right corner, then “Create an account” on the next screen.

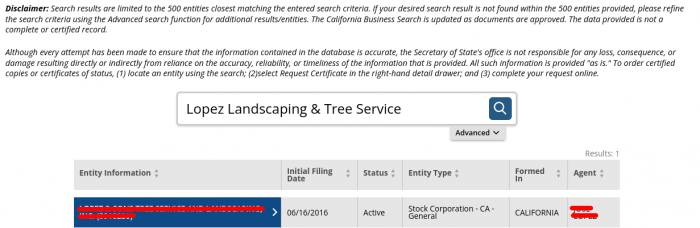

Step 2: Access Your Online Entity

You can search for your business entity using the search bar at the top of the screen. Enter your company’s name or entity number, and then select it from the list provided.

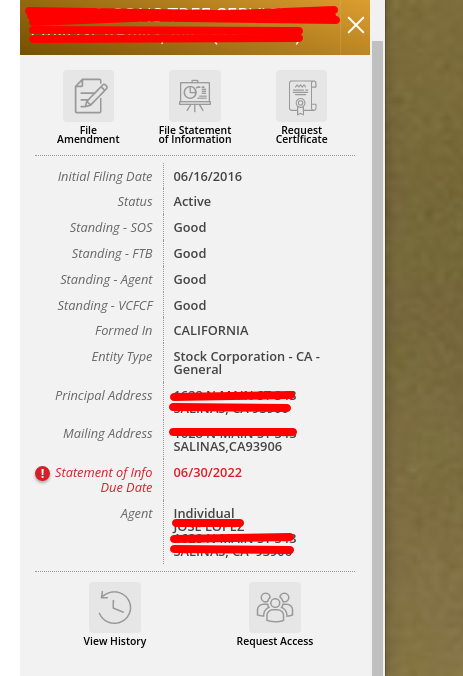

Step 3: Select the “File Statement of Information” Option

Once you have located your business entity, click on it and a bar will appear to the right with your company’s information, including the due date of your statement of information. Click “File Statement of Information” option to start the process.

Step 4: Update and Verify Information

Review the pre-filled information and update any necessary details, such as changes in address, registered agent, or management.

Step 5: Electronically Sign and Date the Annual Report

Verify the information on the annual report, and electronically sign and date the document.

Step 6: Pay the Filing Fee

Complete the filing process by paying the required fee, $25 for corporations, $20 for LLCs, or $75 for LLPs, using a credit or debit card.

Deadlines and Filing Fees

The deadline for filing your annual report in California is annually, by the end of the filing entity’s anniversary month. The cost of filing the report is $25 for corporations, $20 for LLCs, and $75 for LLPs.

Consequences of Filing Late

If you’re more than 60 days late on your annual report you’ll face a $250 fine. Late filing may also put your business at risk of administrative dissolution, which means the state could dissolve your business entity.

Required Information for Your California Annual Report

Here’s all the information you’ll need to have when filing:

- Business Name and Address

- Registered Agent Name and Address

- Business Structure (Corporation, LLC, or LLP)

- Names and Addresses of Directors, Officers, and/or Managers

California Statement of Information Frequently Asked Questions

Yes, a fictitious business name (DBA) can be included in the Statement of Information in California. The Statement of Information provides an opportunity for businesses to disclose any names under which they are conducting business, including any fictitious business names or DBAs they may be using.

Yes, it is possible for nonprofit organizations in California to file the Statement of Information electronically. The California Secretary of State’s office provides an online filing system called California Business Search, where businesses, including nonprofit organizations, can submit their Statement of Information electronically.

Yes, foreign corporations that are registered or qualified to do business in California are required to submit a Statement of Information, regardless of whether they have a physical presence or conduct business activities within the state. The Statement of Information allows the state to maintain accurate and up-to-date information about all corporations operating within its jurisdiction, including those based outside of California.