Wisconsin Certificate of Good Standing: Comprehensive Guide

Obtaining a Wisconsin Certificate of Good Standing, also known as a Certificate of Status, is a crucial step for businesses operating in the state. We’ll show you:

- What a Wisconsin Certificate of Good Standing is.

- When you’ll need one.

- How to get one online or buy mail.

Table of Contents

- Overview: What Is a Wisconsin Certificate of Good Standing

- How to Obtain a Wisconsin Certificate of Good Standing

- Fees and Processing Times and Contact Information

- Reasons a Wisconsin LLC Might Fail to Be in Good Standing

- How to Restore Good Standing to an LLC in Wisconsin That has Lost it

- Frequently Asked Questions

Related Articles

How to Change Your Wisconsin Registered Agent

How to File a Wisconsin Annual Report

Hire a Service to Register Your Company in a Different State

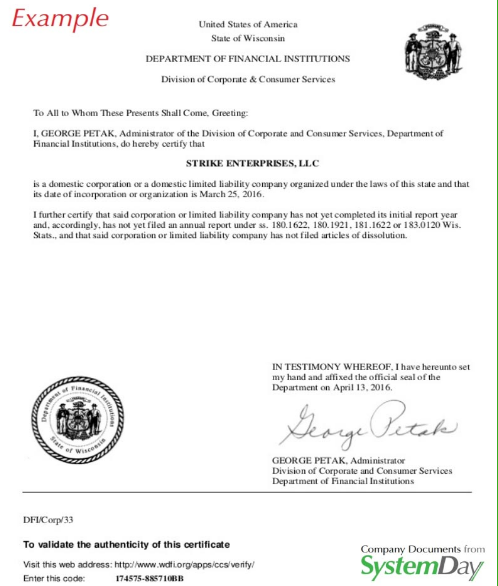

Overview: What Is a Wisconsin Certificate of Good Standing

A Wisconsin Certificate of Good Standing is a certificate that proves your business is operating lawfully in Wisconsin.

If you formed your LLC in Wisconsin and need to provide proof of your LLC’s good standing, then you’ll need to obtain a “Certificate of Status” from the Wisconsin Secretary of State.

The cost of a Certificate of Status from the Wisconsin Secretary of State is $10.00.

The Certificate of Status takes two business days to ship.

Providing proof of good standing for an LLC may be required when:

- Registering an LLC in a state other than the one it was formed in.

- Applying for loans.

- Getting business insurance.

- Opening a business bank account.

How to Obtain a Wisconsin Certificate of Good Standing

Two ways to get a Wisconsin Certificate of Good Standing.

Order a Wisconsin Certificate of Good Standing Online

Step 1. Visit the Wisconsin Department of Financial Institutions website and select “Business Services” from the navigation menu.

Step 2. Select “Submit Document/File Search Request” from the Business Services page.

Step 3. Complete the request form with your Wisconsin LLC information, including the LLC name and Wisconsin file number.

Step 4. Select “Certificate of Existence/Good Standing” as your request type.

Step 5. Pay the $10 fee with a valid credit or debit card.

Step 6. Print out your Wisconsin Certificate of Existence from the Wisconsin Secretary of State website after it is issued.

Order a Wisconsin Certificate of Good Standing by Mail

By Mail: Takes up to seven days plus mailing time, with a standard $10 fee. Expedited service, taking less than two days plus mailing time, is available for an additional $25. Include the business name, payment, return address, specific requests, and a contact number in your request.

In Person: Available at the Wisconsin Department of Financial Institutions offices. Regular processing costs $10, or $20 for a hard copy in addition to a fax. No same-day service. Expedited processing incurs a single fee regardless of the number of certificates.

Fees and Processing Times and Contact Information

Fees and Processing Times

Standard Processing Fee: $10 for both online and mail orders.

Expedited Processing Fee: Additional $25, applicable to all ordering methods.

Extra Costs: $20 for a hard copy plus fax in in-person orders.

Online Processing: Immediate.

Mail Processing: Up to 7 days plus mailing time.

Expedited Processing: Less than 2 days plus mailing time.

Payment Methods

Acceptable forms include checks, money orders (payable to the Department of Financial Institutions), and credit cards (Visa or MasterCard) for online orders.

Electronic vs. Printed Copies

Electronic: Available immediately for printing after online ordering and payment.

Printed: Mailed via regular mail unless a prepaid envelope or UPS/FedEx account number is provided. Fax return is available upon request.

Contact Information

Address: Wisconsin Department of Financial Institutions, Division of Corporate & Consumer Services, PO Box 7846, Madison, WI 53707-7846 or 345 W. Washington Avenue, 3rd Floor, Madison, WI 53703.

Phone: (608) 261-7577

Email: corpinfo@dfi.state.wi.us

Conclusion

The Wisconsin Certificate of Good Standing is an essential document for state-chartered banks, savings institutions, corporations, and LLCs. It verifies the legal and compliant status of a business. Whether you prefer online, mail, or in-person processing, this guide provides all the necessary information to obtain your certificate efficiently. Remember to check for the most current fees and processing times, as these can change.

Reasons a Wisconsin LLC Might Fail to Be in Good Standing

Your Wisconsin LLC may fail to be in good standing if any of the following occur:

- Filing annual reports or other documents late.

- Failure to pay franchise taxes or other fees.

*The Wisconsin Secretary of State will notify you if your Wisconsin LLC is not in good standing and provide instructions on how to remedy the situation.

How to Restore Good Standing to an LLC in Wisconsin That has Lost it

If your Wisconsin LLC has lost good standing, then you’ll need to take the following steps:

1. Visit the Wisconsin Secretary of State website and select “Business Services” from the navigation menu.

2. Select “Submit Document/File Search Request” from the Business Services page.

3. Complete the request form with your Wisconsin LLC information, including the LLC name and Wisconsin file number.

4. Select “Certificate of Compliance” as your request type.

5. Pay the applicable fees to restore good standing status to the Wisconsin LLC.

6. Print out your Wisconsin Certificate of Compliance from the Wisconsin Secretary of State website after it is issued.

7. File any outstanding reports or fees that are due and make sure to pay all current Wisconsin LLC fees on time.

Frequently Asked Questions

The Wisconsin Secretary of State requires a fee of $10.00 to process the request.

It takes two business days for the Wisconsin Secretary of State to process your request and issue the Wisconsin Certificate of Existence.

A Wisconsin Certificate of Compliance is a document issued by the Wisconsin Secretary of State that confirms your LLC’s compliance with Wisconsin laws, and restores it to good standing.

You can restore good standing to your Wisconsin LLC by filing any outstanding reports or fees that are due, and paying all current Wisconsin LLC fees on time. Once you have done this, you can submit a request for a Wisconsin Certificate of Compliance from the Wisconsin Secretary of State.