Texas Registered Agents: The Essential Facts for Small Business

Every business entity operating in the Lone Star State must designate a registered agent – it’s the law. The good news is that there are numerous cost-effective options available that go beyond meeting the basic legal requirements. We’ll guide you through the whys and hows of choosing the right registered agent (hint: it could be you).

Table of Contents

Related Articles

Best Budget Texas Registered Agent

Best White Glove Texas Registered Agent

What a Texas Registered Agent Is and Why It’s Mandatory

A Texas registered agent collects and forwards official state documents and service of process to companies doing business in Texas. If you’re doing business in Texas, you’ll almost certainly need one.

In accordance with Texas state law, specifically Tex. Bus. Orgs. Code § 5.201, business entities are obligated to maintain a Texas registered agent.

Who Is Required to Have a Registered Agent?

The following types of business entities are mandated to have a Texas registered agent:

• Corporations

• Limited Liability Companies (LLCs)

• Limited Partnerships (LPs)

• Limited Liability Limited Partnerships (LLLPs)

• Statutory Trusts

*Note that sole proprietorships and general partnerships are exempt from this requirement.

Understanding the Role of a Texas Registered Agent

A registered agent, whether an individual or a company, plays a pivotal role in receiving legal and official communications on behalf of a business operating in Texas. This system ensures that your company can be easily contacted by the secretary of state and remains accessible in the event of a legal matter.

What a Texas Registered Agent Can do for Your Business

Registered agents in Texas might seem like an annoying requirement, but the truth is they can afford your company invaluable privacy features. Because it’s a competitive market, many also offer services that go above and beyond the requirements of the law. Many Texas registered agents offer free compliance services, mail scanning services, and business formation services for very affordable prices.

Why Texas Registered Agents Are Crucial

Without the registered agent system, many states would have no way to contact business owners, resulting in potential chaos and legal complications.

Compelling Reasons to Opt for a Professional Texas Registered Agent

If your business meets the prerequisites for a Texas registered agent, you may consider acting as your own (more on how to do that down below). However, the benefits of choosing a professional registered agent typically outweigh the costs.

Safeguarding Your Privacy

While forming an anonymous LLC is a common motive for hiring a professional registered agent, even if you don’t require anonymity (most businesses want to be found), you can still benefit from the privacy offered by a professional agent – particularly if they assist in forming your business. This privacy strategy is based on what happens to your information once it enters the public database.

Your Agent Can Register Your Business

Take a look at the Texas Certificate of Formation. If you designate yourself as the registered agent, your personal name and address will be listed. You’ll also be required to sign the document. This information becomes part of the public record, attracting unwanted attention such as spam and potential scams.

However, by choosing a professional registered agent to form your LLC or corporation, their information is submitted to the state and made public instead. This allows you to maintain control over your public exposure and separate your business entity from your personal identity.

Ideal for Home-Based Businesses

Whether you’re aiming for anonymity or not, the privacy offered by a professional registered agent can be especially advantageous if your business operates from your home.

Essential for Out-of-State Businesses

If your business’s principal office is located outside of Texas, it’s likely that you’ll need to engage a Texas registered agent. The exception is if you maintain a staffed office within Texas, and one of your staff members can serve as an authorized signer for registered agent documents.

The Convenience Factor

A reliable Texas registered agent offers more than just the minimum legal requirements. While the mechanics of an LLC or corporation are relatively straightforward, missing critical notices from the state can lead to your business’s dissolution. A Texas registered agent eliminates this risk conveniently and affordably. A reputable agent:

- Provides digital mail access through a client portal.

- Sends timely annual report reminders to ensure compliance.

- Offers free or affordable services, including Operation Agreements and EIN assistance.

Becoming Your Own Texas Registered Agent

Yes, it’s entirely possible to serve as your own registered agent, particularly if you have an office that’s not a home office and is staffed during business hours.

Meeting the Requirements

Are you able to confirm the following conditions? If so, you can legally act as your own Texas registered agent:

- You’re at least 18 years old.

- You have a physical address within Texas (no P.O. boxes or virtual offices).

- Your Texas address is available during business hours to receive service of process and state communications.

- You’re willing to forward legal communications to the LLC owners.

- You’re comfortable with your address becoming a matter of public record.

Making It Official

If you meet these qualifications, simply list your name and physical address on the registered agent section of your formation documents. Proof of eligibility is typically not required. However, it’s crucial to ensure that you promptly receive state communications and legal notices to maintain your LLC’s good standing and limited liability protection.

Recommended Texas Registered Agents

Registered Agents Offering More Than Just the Basics

You can find a comprehensive list of Texas registered agents on the Texas Secretary of State’s website. Here are some recommendations:

Budget-Friendly Option

Texasregisteredagent.net ($35/yr)

Texas Registered Agent is a low-cost stalwart in the industry. You won’t get much in terms of additional services, but you will get a dependable Texas registered agent with same-day mail scans and a slick online client portal.

Best White Glove Texas Registered Agent

Northwest Registered Agent ($125/year)

These guys will form your LLC for $39 and will also list their address instead of yours wherever possible on the Articles of Organization. This is an actual huge benefit, even if you’re not all that concerned about anonymity. The amount of junk mail and spam calls you’ll avoid alone is worth this benefit. Your company’s registered agent is a matter of public record. If you look up an LLC, what you’re going to find is the company’s registered agent phone number and physical address. Spammers love this list. Disgruntled people love this list. Believe me, I still get spam phone calls for the first company I formed over 10 years ago.

These are the added benefits that Northwest Registered Agent offers:

- $39 LLC formation

- Same-day scans and uploads of all legal and state notifications

- Privacy by Default®(They use every opportunity to keep your contact information off of public documentation and do not sell your data)

- Annual report reminders

- A client portal from which you can easily manage multi-state expansion.

Things that are Unique about Texas Registered Agents

Here are a few things about Texas registered agents that are different than most states.

You’ll Need Your Registered Agent’s Consent First

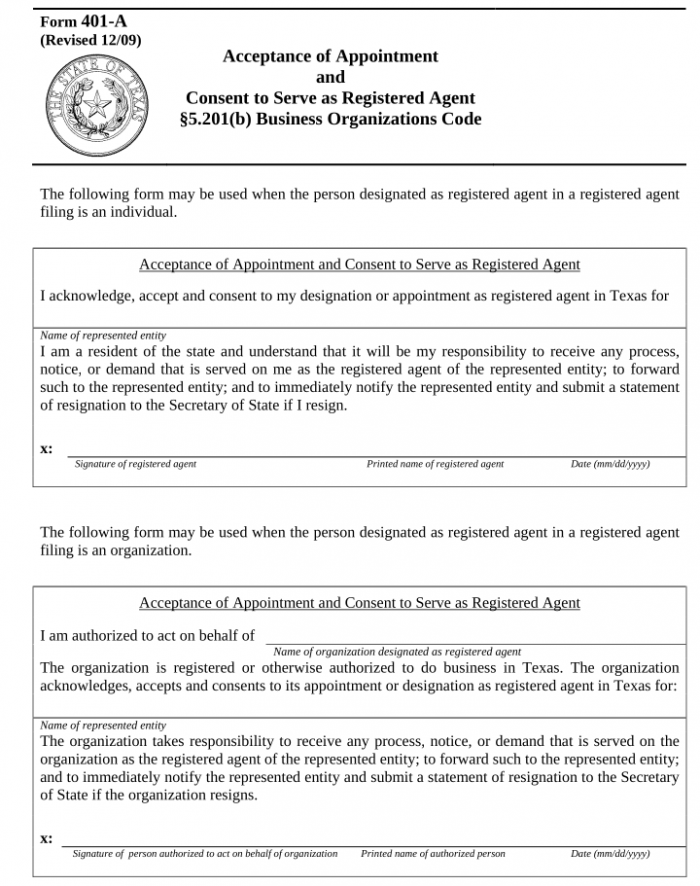

Section 5.2011 of the Texas Business Organization code requires that before designating someone as a registered agent, you must obtain their written consent to serve in that role. This consent typically involves filling out and signing a consent form, which is submitted with the business’s formation or registration documents to the Texas Secretary of State.

This does mean you’ll need to hire your registered agent before forming your business. If you have hired a registered agent to form your entity, they should take care of this for you.

You do not need to pay for the Acceptance of Appointment and Consent to Serve as Registered Agent form. The form can be downloaded from the Texas Secretary of State for free.

History of Texas Registered Agent Legislation

The history of registered agent legislation in Texas traces its roots to the state’s early days as part of the United States. Registered agent laws, which govern the appointment of individuals or entities responsible for receiving legal documents and official notifications on behalf of businesses, play a crucial role in ensuring transparency and accessibility within the business landscape. Here is a brief overview of the history of registered agent legislation in Texas:

Early Statehood: When Texas gained statehood in 1845, it inherited a legal framework influenced by Mexican law, Spanish law, and American common law traditions. While the concept of registered agents may not have been formalized at this time, businesses often relied on designated agents for service of process.

Evolution of Business Laws: As Texas evolved, so did its business laws. The mid-20th century saw significant changes in the state’s approach to business regulation. In 1967, the Texas Business Corporation Act was enacted, providing a more comprehensive framework for corporations and introducing provisions related to registered agents.

The Texas Business Organizations Code (BOC): In 2003, the Texas Legislature passed the BOC, a comprehensive statute that governs various types of business entities, including corporations, limited liability companies (LLCs), and limited partnerships. The BOC established the modern legal framework for registered agents in Texas.

Legal Requirements: The BOC, specifically Tex. Bus. Orgs. Code § 5.201, made it mandatory for certain business entities, such as corporations, LLCs, limited partnerships, limited liability limited partnerships, and statutory trusts, to maintain a registered agent in the state of Texas. This requirement ensured that these entities could be easily contacted by state authorities and third parties.

Adaptation to Changing Business Landscape: Over the years, registered agent legislation in Texas has evolved to accommodate changes in the business landscape. As the state’s economy grew and diversified, the need for efficient communication between state authorities and businesses became increasingly important.

Privacy and Convenience: Texas registered agent legislation has also recognized the importance of privacy for businesses, especially in the age of the internet. Many businesses choose professional registered agents to safeguard their privacy and streamline communication with the state.

Frequently Asked Questions

Yes, a business owner from out of state can serve as their own Texas registered agent if they meet specific requirements. They must have a physical address within Texas, be available during business hours to receive service of process and state communications, and be willing to forward legal communications to the LLC owners. However, it’s essential to ensure prompt receipt of state communications and legal notices to maintain the LLC’s good standing and limited liability protection.

A professional Texas registered agent can help protect your privacy by having their information submitted to the state and made public instead of your personal name and address. This separation between your business entity and personal identity can reduce spam and potential scams, even if you don’t require anonymity. It provides an added layer of privacy, especially if the registered agent assists in forming your business.

Are there any specific advantages to using a Texas registered agent for home-based businesses?

A reputable Texas registered agent goes beyond meeting the minimum legal requirements. They can offer convenience and help ensure compliance by providing digital mail access through a client portal, sending timely annual report reminders, and offering free or affordable services such as Operation Agreements and EIN (Employer Identification Number) assistance. This helps prevent the risk of missing critical notices from the state that could lead to your business’s dissolution.